Whether you’re planning to expand your small business, need working capital, or want to upgrade your infrastructure, WeRize makes it easy to access business loans online — all from the comfort of your home.

With multiple lenders onboarded on the WeRize platform, you can get the best loan offers as per your business profile, at competitive interest rates, with minimal documentation and a 100% digital process.

✅ Business Loan Features with WeRize

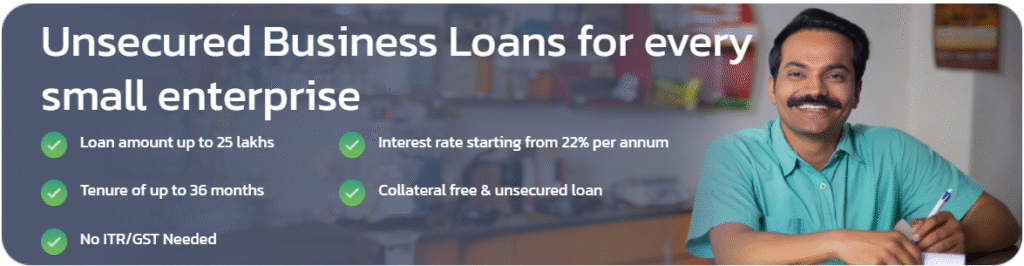

- 💼 Loan Amount: ₹50,000 to ₹25 Lakhs*

- ⏱️ Quick Processing and Instant Approval

- 📄 Minimal Documentation

- 💳 Flexible Tenure: 6 to 36 months

- 🏦 Multiple Lender Options – Choose Best as per Your Criteria

- 🔐 100% Safe, Secure & Paperless Process

- 🌐 Pan India Access – Apply from Anywhere

👥 Business Loan Eligibility Criteria

For Business Owners (Self-Employed Professionals or Entrepreneurs):

- Age: 21 to 60 years

- Business should be operational for at least 1 year

- Minimum monthly income: Based on lender (generally ₹15,000 and above)

- Should have a valid business proof (GST, Shop Act, etc.)

For Customers Applying for Business Loan:

- Indian citizen with valid ID proof

- Good credit history preferred

- Stable source of income (business or profession)

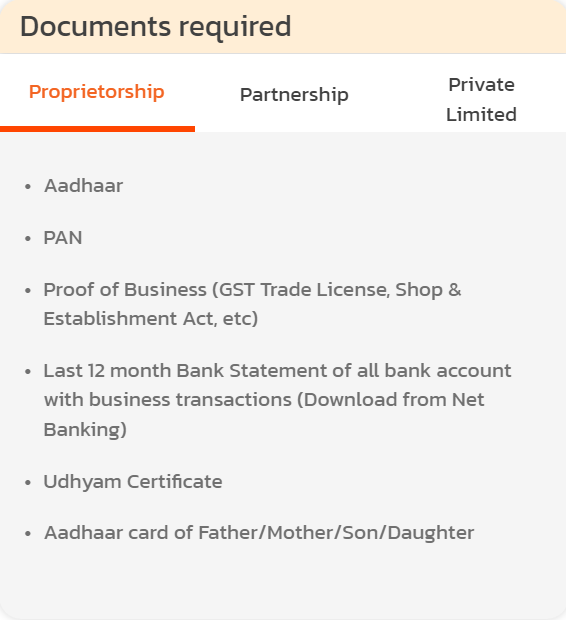

📄 Documents Required

- PAN Card (Individual & Business)

- Aadhaar Card (For KYC)

- Business Proof (GST Certificate, Udyam, Shop & Establishment, etc.)

- Bank Statements (Last 6–12 months)

- Income Proof (ITR, Profit & Loss Statement, etc., as applicable)

- Photograph (Recent passport-size)

Note: Specific document requirements may vary depending on lender policies.

🎯 Key Benefits of Business Loan from WeRize

- ✔️ One platform, many lender options – compare and choose

- ✔️ No hidden charges – transparent terms

- ✔️ Fast disbursal directly to your bank account

- ✔️ Ideal for small businesses, startups, and freelancers

- ✔️ Personal and business loans both available under one roof

🙋♂️ Frequently Asked Questions (FAQs)

Q1. What is the interest rate for a business loan at WeRize?

A: Interest rates start as low as 10.5%* p.a. and vary based on your credit profile and lender.

Q2. How long does it take to get the loan disbursed?

A: Once documents are verified, the loan can be disbursed within 24 to 48 hours.

Q3. Can I apply for both personal and business loans on WeRize?

A: Yes! WeRize offers both personal and business loans with easy online application.

Q4. Do I need to visit a branch or meet an agent?

A: No physical visit needed! The entire process is 100% online and paperless.

Q5. What if my CIBIL score is low?

A: You may still be eligible, depending on other factors. WeRize works with multiple lenders, some of whom consider alternate criteria beyond CIBIL.

🚀 Apply for Business Loan Online with WeRize Now!

Don’t let funds hold back your growth. Apply now for a business loan online with WeRize and take your business to new heights!

Other Article

- Apply for Business Loan Online from WeRize – Fast, Easy & Hassle-Free!Whether you’re planning to expand your small business, need working capital, or want to upgrade your infrastructure, WeRize makes it easy to access business loans online — all from the comfort of your home. With multiple …

- Personal loan Company List 2025Get the best loan offers at lowest interest rates starting at 10.99% p.a.* 💡Loan up to Rs. 20 Lakh💡Min. Documentation💡100% Digital Process💡40+ Banks and NBFCs Best Personal Loan Company List List of Personal Loan Company KreditBee …

- India’s Digital Payments RevolutionIndia has undergone a remarkable transformation in its digital payments ecosystem over the past decade. With the launch of systems like UPI (Unified Payments Interface) and initiatives like Digital India, the nation is quickly becoming a …

- ABFL Finbox Instant Personal Loan: Ek Instant Solution Aapki Financial Zarooraton Ke Liye!Kabhi-kabhi zindagi mein kuch aise pal aate hain jab humein turant paise ki zaroorat hoti hai—chahe woh emergency medical expense ho, sudden travel plan, ya business mein quick investment ka mauka. Aise mein, ek trusted aur …

- 🌟 Kiwi Credit Card: Unlock Your Financial Power! 🌟Kiwi Credit Card is designed to give you more than just the convenience of payments. It’s packed with benefits and features that help you save while you spend. Whether you’re a frequent traveler, a shopping enthusiast, …